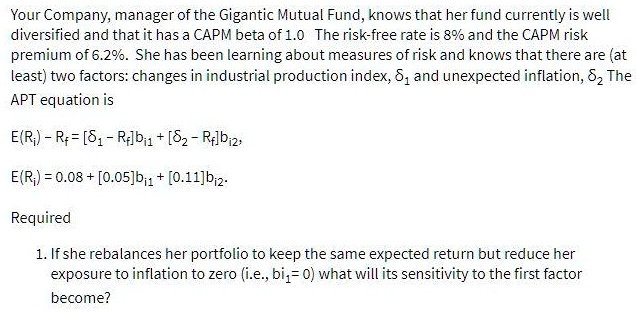

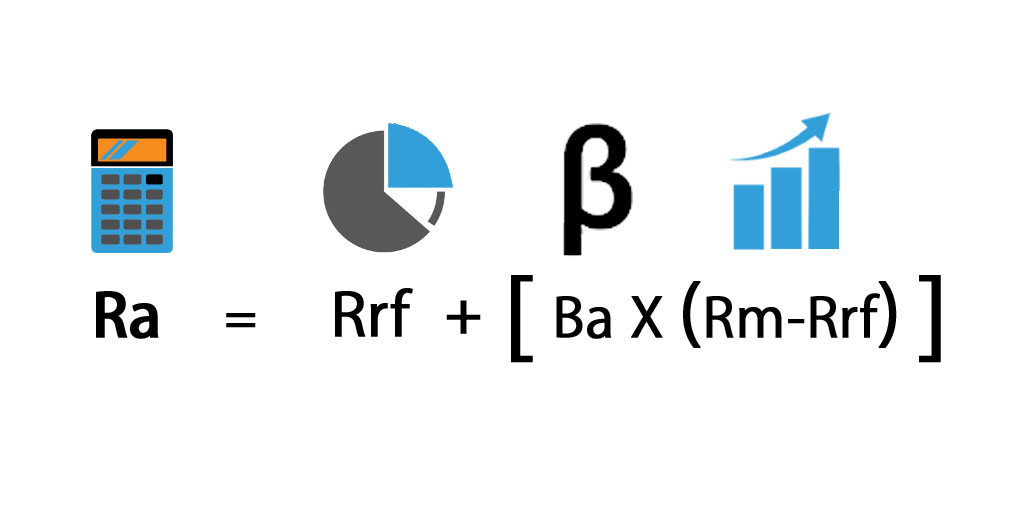

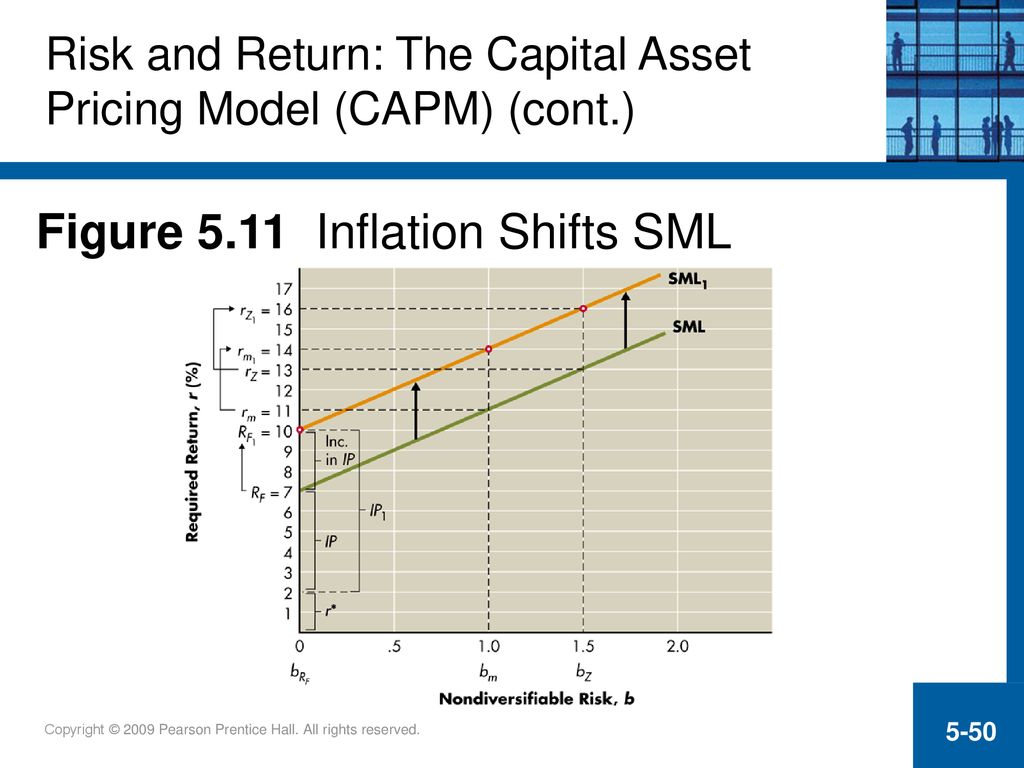

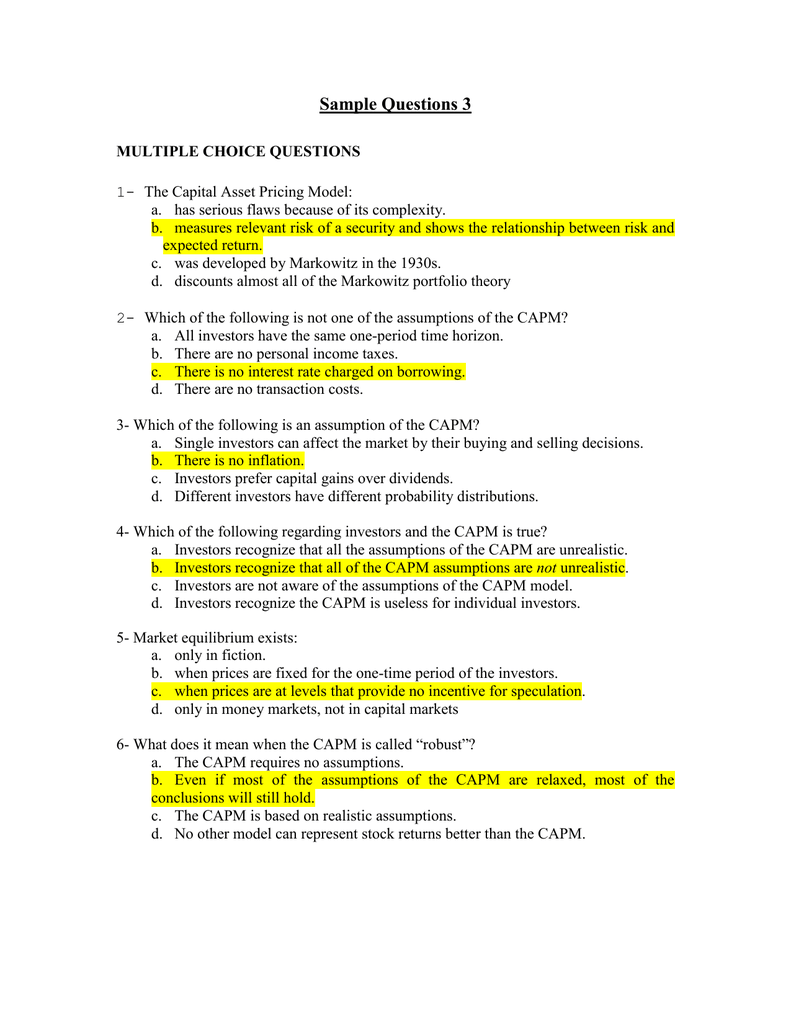

Lecture: 3 - Stock and Bond Valuation How to Get a “k” to Discount Cash Flows - Two Methods I.Required Return on a Stock (k) - CAPM (Capital Asset Pricing. - ppt download

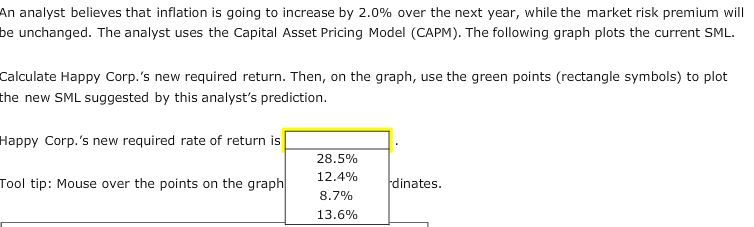

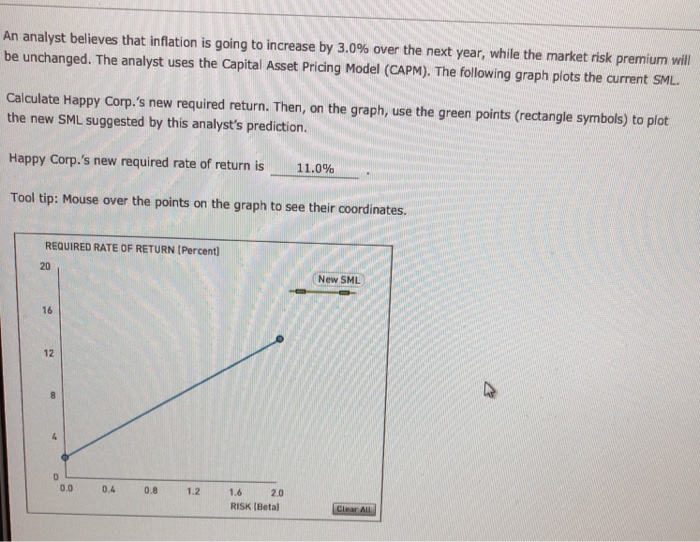

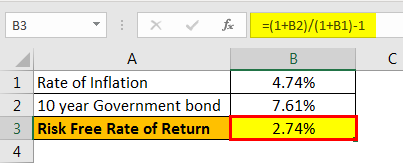

An analyst believes that inflation is going to increase by 3.0% over the next year, while... - HomeworkLib

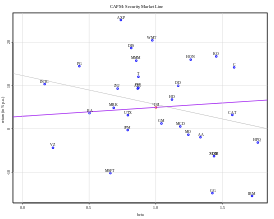

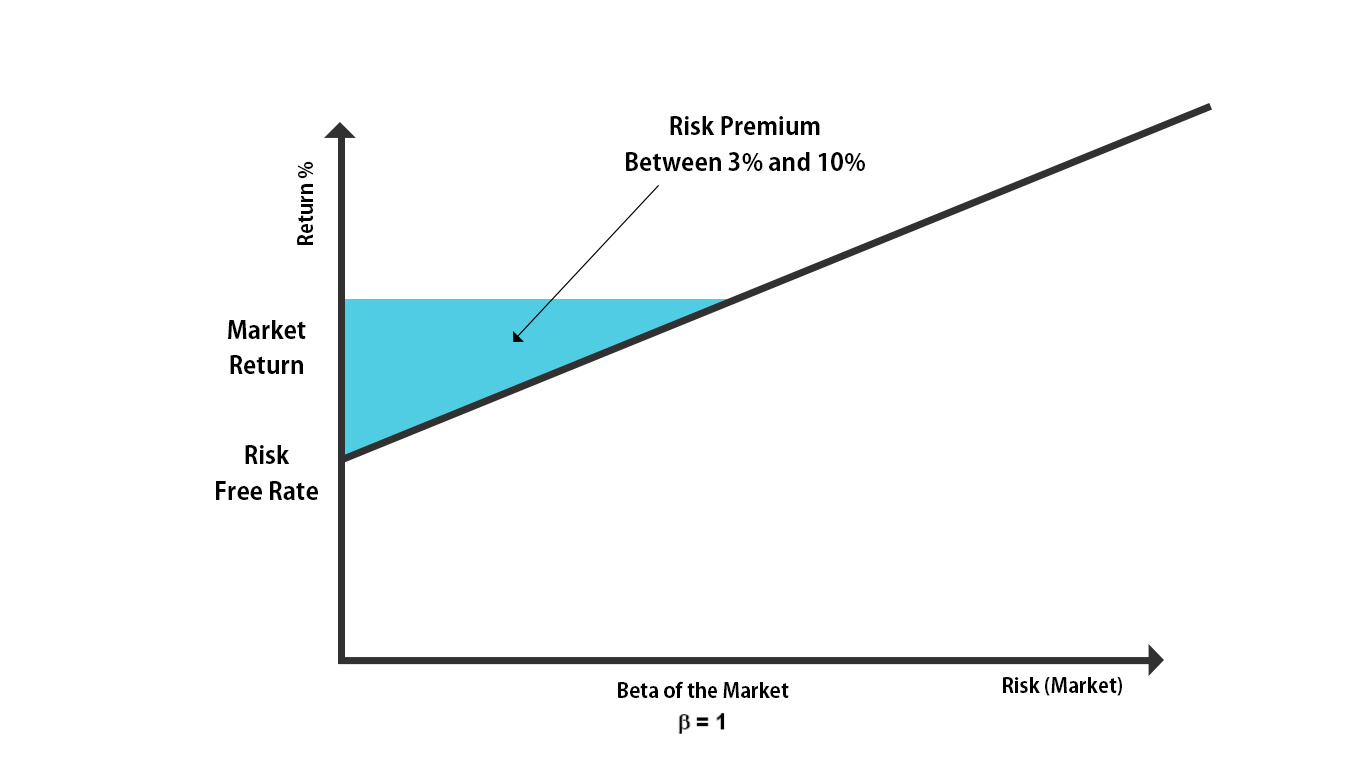

![Figure A1. Representation of CAPM [Capital Asset Pricing Model] and the... | Download Scientific Diagram Figure A1. Representation of CAPM [Capital Asset Pricing Model] and the... | Download Scientific Diagram](https://www.researchgate.net/profile/Sander-Epema/publication/344371004/figure/fig1/AS:939415513866240@1600985520565/Figure-A1-Representation-of-CAPM-Capital-Asset-Pricing-Model-and-the-SML-Security.png)

Figure A1. Representation of CAPM [Capital Asset Pricing Model] and the... | Download Scientific Diagram

5. Changes to the security market line The following graph plots the current security market line... - HomeworkLib